How Is Pet Insurance in 2025 More Transparent, Tailored?

The pet insurance landscape has undergone rapid changes in the past few years, and it is now far more comprehensive than just accident or illness coverage. In 2025, the pet insurance industry is well on its way to a transformation fueled by technology, greater consumer awareness, and legislative change; thereby, making pet insurance policies more available, more transparent, and more personalized than ever before. Not surprisingly, today’s pet parents are seeking clarity, fairness, and flexibility, and insurance providers are beginning to respond.

The Shift Towards Clarity in Transparent Pet Insurance

As pet owners, we have become increasingly dizzy with not knowing exactly what the “fine print” of our insurance policies means over the years. Sometimes there are exclusions, sometimes there are caps, and way too often there are definitions that need to be revisited and elaborated upon at the unfortunate time of claiming, which is counterintuitive. So, at a glance, we are seeing an evolutionary leap at the starting block in 2025.

In the UK and EU, new rules require insurers to present clear exclusions in simple formats before purchase. Similar regulations are emerging in India, limiting complex policy documents and adding easy-to-read benefit visuals. Transparency is now both a legal requirement and a sales strategy, with providers promoting “no hidden clauses” as part of their brand.

And pet owners are educating themselves more with comparison platforms and reviews that provide comparative information on policies and coverage in a straightforward manner. With this transparency, trust between pet parents and insurers is continually increasing.

Personalization Through Technology in Transparent Pet Insurance Plans

In 2025, another prominent driver of change will be personalization. The idea that all pets fit under the same insurance umbrella is fading away. Insurers will begin offering tailored plans based on the breed, age, health history, and even lifestyle.

For instance, wearable pet health trackers now connect directly to insurance companies. If your dog’s activity and heart rate data show they are healthy, you might lower your premiums or qualify for wellness credits. AI also helps when selecting an appropriate coverage option, predictive analytics helps ascertain the likelihood of specific conditions, allowing a Transparent Pet Insurance provider to offer wellness add-ons before a problem even arises.

This can be a win-win for your pet, and owners feel like they only have to pay for what they truly need, and not for unnecessary extra services.

Coverage Beyond the Basics with Transparent Pet Insurance

In earlier generations, the focus on pet insurance was on emergencies, accidents, sudden illnesses, and surgeries. In 2025, coverage is being broadened to better reflect current values regarding pet care. Many policies now cover:

- Preventive care: yearly evaluations, vaccines, dental cleanings, and routine labs.

- Alternative Therapies: hydrotherapy, acupuncture, herbal medicine, and physiotherapy are now maintained as therapies where sometimes insurances will cover, which equates the therapy also with the ability to be affordability.

- Behavioral Therapy: As more behavior problems are being linked to overall health, some pet health insurance plans will cover consulting sessions or training for anxiety, aggression, and compulsive behaviors.

This explosion of whole-pet wellness is part of the trend toward “pet humanization”, where people see their pets as family members deserving access to the same comprehensive healthcare.

Bundled Wellness Plans

One notable advancement in 2025 is the incorporation of wellness and insurance coverage. Pet parents no longer need to juggle many separate wellness memberships and emergency coverage, but can now obtain one premium that incorporates both.

Typically, the packages can come with preventative visits, grooming appointments, vaccinations, flea and tick treatments, and full accident and illness coverage. The simple fact that pet owners have only one predictable payment to make every month makes budgeting for pet owners far easier and allows the pet owner to be sure that their pet’s care is consistent throughout the course of the year. Transparent Pet Insurance options make these bundled plans even more appealing by ensuring clarity in coverage and costs.

This model appeals particularly to first-time pet owners in markets like the US and India, especially those who want a more “set-and-forget” mindset towards pet healthcare.

Rising Costs and the Push for Value

The news is not all good, veterinary care costs are still increasing. In the US, average annual premiums for comprehensive dog insurance have risen around 8% since 2024. Inflation, advances in veterinary technology, and the demand for higher-quality care all factor into these costs. Transparent Pet Insurance providers are working to offset these rising expenses by offering clearer terms and better value-added services.

But the industry is making a response by focusing on value. Many providers are offering multi-pet discounts, loyalty bonuses, and life with tele-vet services included as part of the premium. Beyond just the extra features, insurers are focusing on overall value to counterbalance a good base rate with other value-added features.

The Global Picture: India’s Rapid Growth

India is home to a developing pet insurance market in 2025. Pet insurance is prevalent in North America and Europe, and here, we are seeing a quick uptick in pet insurance use as pet ownership in urban areas continues to rise, veterinary costs have increased, and individuals are more aware of financial planning for their pets.

Offering some unique products that don’t just cover illness and injury. They are adding chronic conditions like arthritis, alternative therapies, and more. India’s insurance offerings are starting to catch up quickly to global standards. Digital claims processing, cashless vet networks, and faster turnaround times are also allowing for the idea of pet insurance to be more attractive for tech-savvy Indian pet parents.

What Pet Parents Should Look For in 2025

There are a number of choices available to you, so making the right policy selection involves a careful evaluation of many factors beyond price. Here are just some of the factors you should consider:

- Transmission of Terms: Does it make all exclusions and limits clear?

- Customizable Options: Are you able to amend deductibles, coverage limits, and add-ons to fit your pet’s needs?

- Preventive Care Coverage offered: Can you receive support for normal care, not just emergencies?

- Reimbursement Claim Processing Time: How quickly does it process and reimburse claims?

- Network / Any Vet Choice: Are you restricted in some sort of network with certain clinics, or can you practice your freedom of choice?

The great news is, in 2025, you can find a policy with as much included coverage as possible, ticking off all these bullets on the policy list.

Final Thoughts

As we enter the year 2025, pet insurance is smarter, clearer, and much more flexible than it was only a few years ago. Transparency is no longer a choice, but a competitive advantage. Technology is enabling customized coverage, and improvements in many aspects of coverage are aligning with our modern view of pet wellness.

For pet parents, it means greater control, fewer nasty surprises, and coverage that takes their pets’ lifestyles into account. With the industry advancing as it is, one thing is certain: the future of pet insurance will be built on trust, technology, and respecting the human-animal bond.

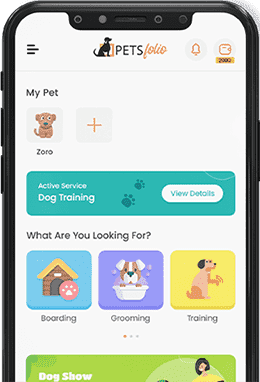

Petsfolio recognizes your pet is not just an animal but a member of your family. Petsfolio provides professional guidance and individualized pet care services to provide your furry family member a healthy and happy life, with the right help and support for each chapter of their journey.

Send us a Message

Enjoy this post?

Check out some more great articles and other content.

The Indian festival of lights known as Diwali is a festival that makes all Indian hou...

Read The ArticleOnce Diwali lights up homes across India, Nepal celebrates Diwali for dogs, a heartwa...

Read The ArticleDiwali is the festival of lights that symbolizes happiness, hope, and unity. The glow...

Read The Article

Download App

Download App Join

Join Support

Support