Why Pet Insurance Is Booming in 2025 for Owners?

Over the past years, keeping pets has been turned into a full-fledged investment, and with pet insurance booming in 2025, owners now see coverage as essential rather than optional. This has spread into the financial sector, where pet insurance is becoming a necessity and less of a luxury by 2025. This boom is being propelled by increasing veterinary expenses, technological gains, and the increased humanization of pets. To pet parents, this development also entails improved care, increased options, and a sense of greater peace of mind-yet a must to negotiate new complexities in policies and prices.

The Market Surge in Pet Insurance is Booming in 2025

The pet insurance booming in 2025 reflects a global industry increasing its rate of growth at a remarkable pace. By 2025, the industry is projected to exceed USD 8.5 billion. Moreover, it is expected to rise to near USD 10 billion by 2030. Europe is the best adopter, with Sweden ensuring close to 90% of their pets, North America, and the Asia Pacific are recording a dramatic growth every year. The 2025 projections show that there would be almost 21 percent growth in insured pets beyond 2024, and that the pets insured in the US had additional territories that were above 6.4 million.

India, too, is catching up. As the number of pets grows with the urban middle-class families, insurers are designing affordable and tailor-made plans beginning as low as 300 per month. According to market projections, India’s pet insurance market will reach USD 1.6 billion annually by 2030. In comparison, it currently stands at USD 662 million in 2024.

This increase indicates not only greater awareness but also a rising need for advanced pet medical care. For example, surgeries, disease management, and chronic treatments are becoming more common. As a result, costly bills make insurance an essential safety net for pet owners.

Why Pet Insurance Is Booming in 2025

A combination of many interconnected reasons explains why pet insurance booming in 2025, has become a worldwide trend:

- Humanization of Pets: More owners have come to treat their pets as an extension of the family. This emotional bond motivates readiness to spend on long-term health care.

- Increasing Veterinary Expenses: Pet owners can now receive advanced medical services previously offered to humans, including MRI, cancer treatment, and even an organ transplant. They are associated with huge bills that insurance can cover.

- Preventive Care Focus: This is moving care more towards proactive than reactive by offering insurance policies that cover wellness benefits such as vaccinations, dental cleaning, and annual checkups.

- Regulatory Support: New legislation in states such as California and Maine requires transparency in the policy terms, which builds trust and motivates implementation in such regions as the U.S.

- Global Awareness: In Europe, the developed markets, as well as in India, the new space, awareness campaigns, and digital aggregators are making the policies more reachable and understandable.

Technology: A Game-Changer for Pet Insurance Booming in 2025

The year 2025 marks a turning point. Technology now plays a central role in pet insurance booming in 2025. Claims processing is faster with artificial intelligence and automation. Real-time approvals and direct payments to veterinary clinics are becoming common. Companies like Trupanion test AI software that settles claims instantly, reducing owner anxiety.

Pets now use wearables to track heart rate, sleep, and activity. These devices are becoming part of modern care. Some insurers offer discounts for pets with healthy activity records, similar to fitness apps for humans.

Telemedicine has also gone airborne. For example, Fetch by The Dodo offers virtual vet consultations as part of its coverage. This gives pet parents quick and affordable access to professional guidance.

More Choice, More Customization

Today, the pet insurance business is custom-made as compared to the previous one-size-fits-all plans. Owners have an option of breed, age, or lifestyle policies. A new trend is the rise of bundled policies. These make coverage easier and cheaper for families with multiple pets. Insurers now also expand services to exotic pets, including birds, reptiles, and rabbits.

In most regions, insurers now offer preventive care riders and wellness reward programs. Special add-ons like hydrotherapy or genetic disorder coverage are also available. This change means owners can create policies that match their pets’ exact needs without compromise.

The Challenges of Pet Insurance Booming in 2025

There are still hurdles even in the face of the boom. One of the greatest concerns is premium inflation. When pets get old or develop a condition, the premiums tend to increase, and some owners cannot afford to cover them. Despite the improvement, transparency remains a world issue, and exclusions and waiting times are misinterpreted.

In the developing markets such as India, there is low awareness. Survey shows two-thirds of pet owners know about insurance, but only one-quarter actually buy it. Most people feel that insurance is too expensive, yet there are some cheap options. The solution to this gap will be education and outreach.

What It Means for Owners

For pet parents, the rise of insurance in 2025 has both immediate and long-term implications:

- Financial Security: The owners no longer have to fear losing their savings to the sudden vet bills. Insurance is a cushion against unexpected problems.

- Greater Access to Better Care: Owners are more likely to accept advanced treatments they would have refused to accept because of cost, with coverage in place.

- Peace of Mind: Owners can relax knowing their pet is insured and not overwhelmed by money concerns, as they can concentrate on bestowing care on their pets.

- Greater Responsibility: Owners now need to consider plans and premiums, and coverages with better care, to stop falling into traps. The number of options is empowering yet demanding of hard work.

Looking Ahead

The pet insurance boom in 2025 is not only a matter of numbers but also a reflection of changing owner mindsets. Owners are demanding more and more to have their pets accorded the same security in healthcare as human beings. The future of pet insurance is bright with the advent of new technologies that offer better experiences, wide policy diversification by the insurers, and the ability of the global market to keep up.

To pet owners, the explanation is simple: insurance is no longer a choice. It constitutes a crucial action towards guaranteeing the lifelong well-being of their furry, feathered, or scaled friends.

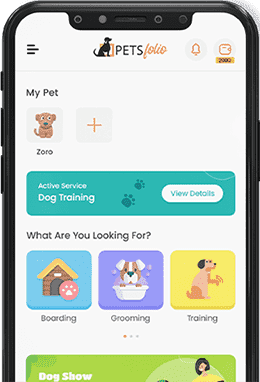

And with brands such as Petsfolio leading the charge in holding the pet industry accountable, be it training and grooming or creating awareness through responsible pet ownership, the pet care ecosystem is going to be stronger than ever before, making pets healthier, happier, and better-taken care of than ever.

Send us a Message

Enjoy this post?

Check out some more great articles and other content.

Should it admit itself to robbery of socks, or tell more than that, the dog diary sec...

Read The ArticleAs soon as winter comes and the temperature drops, winter dog walking safety becomes ...

Read The ArticleYou already know that no card in the deck can make your heart melt like the cutest do...

Read The Article

Download App

Download App Join

Join Support

Support